Recent media reports regarding the automotive industry can be misinterpreted. Although light vehicle sales in North America have attained record levels and future forecasts indicate these levels will be sustained for the next several years, you could be missing growth opportunities. As a manufacturing company, if you subscribe to the conclusion that “status quo” is the way to proceed, you’re assumptions may lead you astray.

Likewise, some media reports suggest that the unprecedented level of investment in Mexico will eventually lead to lost jobs for the United States manufacturing sector.

Let’s take a more detailed look to clarify these assumptions surrounding the automotive manufacturing supply:

- Point #1: When you read published numbers relative to the North American Automotive Industry it is important to recognize the difference between Sales and Production numbers.

- Point #2: What is the impact of the manufacturing surge into Mexico?

- Point #3: Tier 2 and 3 suppliers face quite different challenges versus Tier 1 suppliers.

Point #1: Sales vs. Production

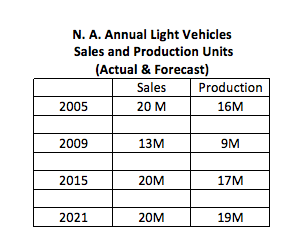

Prior to the economic downturn in 2009, the peek North American (U.S., Canada and Mexico) Automotive Light Vehicle Sales occurred in 2005 and 2006 timeframe. The sales volume attained during that period was approximately 20 million vehicles. In 2009 the North American sales plunged to approximately 13 million vehicles. In the 2014 to 2015 timeframe, sales have returned to 20 million. This data is documented by IHS Automotive, McKinsey and Company and others. The forecast going forward would indicate that the sales volume for North America will grow slightly to something less than 21 million vehicles in 2017 before returning to 20 million units level in 2021.

By analyzing just the sales numbers one could conclude that not only has North America returned to the peak levels achieved prior to the downturn, but we are expected to stabilize at these levels for the next several years. As a manufacturing entity, this conclusion could cause your company to miss a very significant growth opportunity in the next few years. Therefore, we must also analyze the production numbers.

As we dig a little deeper into the data, as presented in the chart above, we find a quite different conclusion. Let’s compare this 2021 forecasted production number (19 million) to the actual number of units produced at the depth of the downturn in 2009, approximately 9 million light vehicles. Because of this severe variation in production numbers it is easy to see why we in the automotive manufacturing sector feel like we have been on a roller-coaster ride. This data, as reported by numerous sources, indicates that the growth period will extend for several more years. Conclusion: The ride is not over! North American Automotive production will continue to rise.

Point #2: Surge into Mexico

Many news articles have been published over the past several months regarding the unprecedented growth of automotive manufacturing capacity in Mexico. Just in the last few years over $20 billion of automotive manufacturing investments have been made in Mexico. Likewise, research indicates that every major OEM currently producing vehicle in the United States plans to add manufacturing capacity in Mexico before 2022. This is supported by the data in Point #1.

Reflecting on the data provided above, this surge of growth in Mexico does not necessarily mean the US will lose automotive manufacturing jobs to Mexico. As a matter of fact, IHS Automotive forecasts that the Compound Annual Growth Rate (CAGR) for light vehicle manufacturing production in the US will be 1.2% between 2014 and 2020. Not outstanding growth, but growth none-the-less. The same source would indicate that Mexico’s CAGR during this same period will be 7.1%. (Note: During this same period, 2014 to 2020, Canada’s forecasted CAGR is a negative 4.3%). Mexico will expand production by approximately 1.5 million units between 2014 and 2020, US by 800,000 units, and Canada will decline by 800,000 units. Conclusion: A migration of jobs to Mexico is not a forgone conclusion.

Point #3: Tier 1, Tier 2 or Tier 3?

All of the evidence indicates that automotive OEMs are adding capacity in Mexico. Subsequently, most of the large Tier 1 suppliers will be encouraged, if not “required” to add manufacturing capacity in Mexico as well. All of this must be accomplished without diminishing or impairing the current installed capacity in the United States. Because of the shortage of experienced managerial and technical resources, this becomes a difficult balancing act.

It would appear from the data analyzed to date that the path to Mexico for the OEMs and large Tier 1 suppliers is well established. But what is the path for Tier 2 and 3 suppliers? The decision to move your small Tier 2 or 3 operation to Mexico is a very “high risk” proposition for many reasons. Simply adding capacity i.e., a manufacturing facility in Mexico could jeopardize the entire manufacturing viability of the small supplier. Small automotive supplier manufacturing companies need to proceed slowly with a clear detailed plan on how to grow successfully. There are many other options to expand rather than moving your business to Mexico. Conclusion: Small to Medium-sized suppliers need to consider all viable options to capture the expected growth.

Did you enjoy this blog? Search our blog library for other topics of interest: https://highvaluemanufacturingconsulting.com/blog/