By Bill May

“State of flux” is an idiom that means something is constantly changing or in a state of uncertainty. This seems to be an accurate analysis of the U.S. Automotive Industry in 2024.

Ever-changing market segregation, changing government directional priorities, infrastructure short-comings and cost reduction implications are all driving a level of uncertainty not seen since the 1970’s energy crisis.

Additionally, the rush to introduce Battery Electric Vehicles (BEV) has led to over-stressing the new product launch capacity of many Automotive OEMs and their suppliers. At the same time the United States is realizing a multiple decade’s peak in new manufacturing construction as we prepare the country for the on-shoring of computer chips and other manufactured products.

Launch Timeline

As a point of background: Tesla took over a decade to design, develop, and produce the current Tesla line-up of electric vehicles. Although their U.S. sales exceeded 650,000 in 2023, Tesla has gone through innumerable learning cycles to perfect their revolutionary product line-up during that period.

2021 saw an “explosion” of hybrid, plug-in hybrid, and BEV vehicle introductions and sales. Sales penetration of these three powertrain configurations rose from 3% penetration to over 15% in the 5 years between 2019 and 2023 approximating 2,000,000 units per year growth. Tesla represented a significant portion of those sales.

One of the many results of “rush to market” can be poor product/manufacturing quality at launch.

Automotive Quality

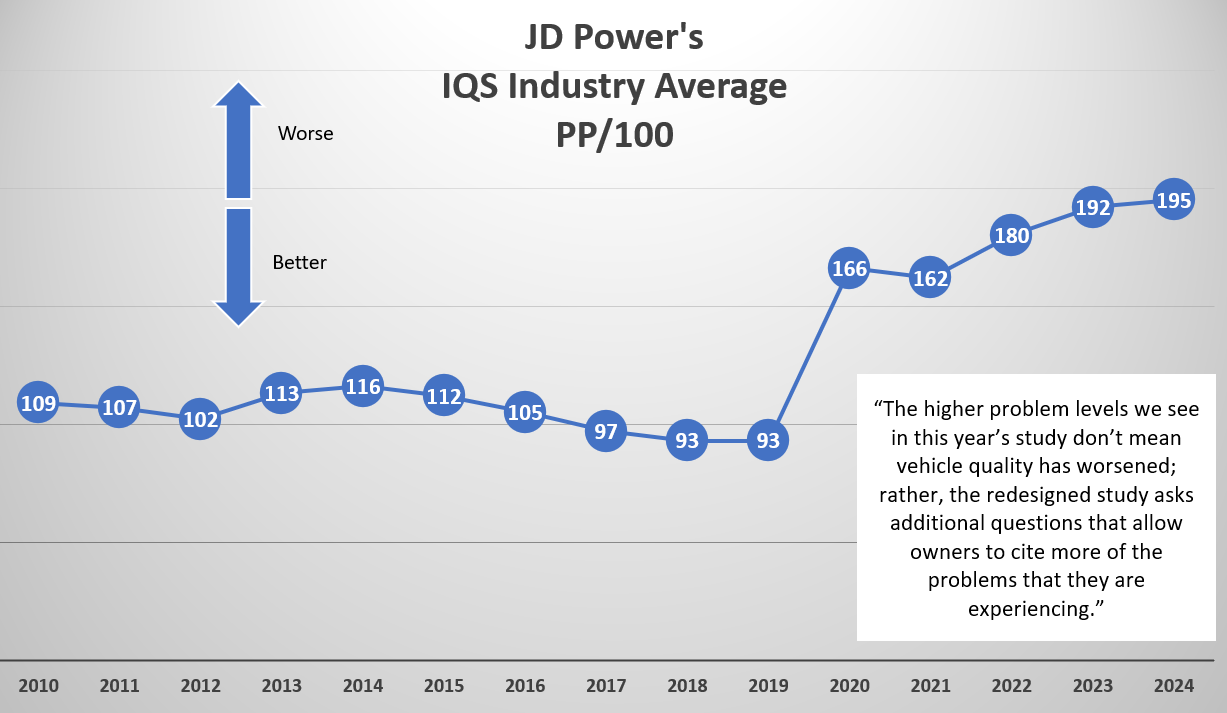

An accepted indicator of automotive industry product quality is the JD Power’s Initial Quality Survey results.

To quote JD Power: “Since 1987, the J.D. Power U.S. Initial Quality StudySM (IQS) has served as the auto industry standard for benchmarking new vehicle quality.”

JD Power’s redesigned the IQS survey questions in 2020 to better reflect the types of problems the owners were experiencing. The average PP/100 over the 10 years prior to these adjustments indicate a 17% improvement in the quality measurement. Interestingly, since the modifications in 2020 the average IQS indicator has seen a 15% degradation.

Simultaneous to the introduction of new technologies, the U.S. Automotive companies and suppliers were going through significant reductions in resources. Many times these reductions were focused on the most experienced workers.

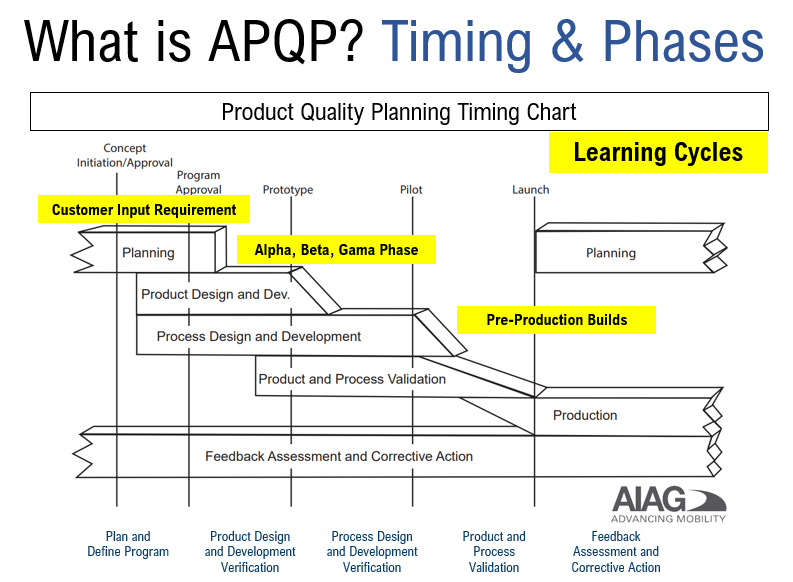

High Value Manufacturing’s analysis of this concerning quality trend is that many of these issues can be attributed to a lack of knowledge and experience with launching new products. Specifically, not understanding well-tested and validated new product development, design, and manufacturing principles. These principles are captured in the Advanced Product Quality Planning (APQP) process.

Advanced Product Quality Planning (APQP)

APQP is a “structured method of defining and establishing the steps necessary to ensure that a product satisfies the customer and meets all performance and quality requirements.”

APQP was developed by the Automotive Industry Advisory Group (AIAG) in 1980s-1990s to provide “standardized best practices” for Advanced Product Quality Planning.

The Future of U.S. Automotive

As we look into the future what can we expect?

Forward looking automotive technology choices include:

- Fuel Cell Electric Vehicle (FCEV) vs Battery Electric Vehicles (BEV) vs Plug-in Hybrid Vehicles (PHEV) vs Hybrid vs Internal Combustion Engine (ICE) vehicles

- Pouch Battery Cells vs Cylindrical Battery Cells vs Prismatic Battery Cells

- Lithium-ion vs Nickel-metal Hydride vs Solid-state batteries

- And likely yet to be identified technologies

The U.S. Auto market has fluctuated between a high of 17.4M units per year and a low of 10.4 M units in the last 25 years, settling in at 14M to 15M range over the last four years. Additionally, these ever-changing market requirements, based on the above factors has created utter havoc in OEMs’ manufacturing capacity plans and has exacerbated the supply base scheduling and planning requirements.

If you think the last 5 years have been havoc and confusion, what do you think the next 5 years will look like?

Did you enjoy this blog? Search our blog library for other topics of interest: https://highvaluemanufacturingconsulting.com/blog/